Unlocking Value for a Real Estate Brand: The Power of Advanced Audience Targeting and Measurement

VideoAmp Advanced Audience Reach & Frequency Reporting Now Part of Roku’s Measurement Partner Program

VideoAmp has announced the integration of Roku – the leading TV streaming platform in the U.S. and Mexico by hours streamed* and the #1 selling TV operating system in the U.S., Canada, and Mexico in Q4 2023** – into its industry-leading measurement solution. VideoAmp’s new collaboration with Roku enables reach and frequency measurement against advanced targets leveraging first or third-party data, making it easier for marketers to understand the impact their TV and streaming buys have on reaching their most valuable audiences.

*Source: Hypothesis Group, Dec 2023

**Source: Circana, Retail Tracking Service, Unit Sales, Oct-Dec 2023 combined

Objective

In a competitive media environment, a real estate Brand was looking to make their media buy more efficient and hit in-market customers across their media channels. With Roku’s advanced targeting and VideoAmp’s advanced audience measurement, the Real Estate Brand went beyond traditional age/gender demos and hit their in-market audience at the ideal frequency and was able to access actionable performance insights to improve the effectiveness of their cross-channel investments.

Approach

VideoAmp helped the Real Estate brand uncover actionable insights on their Roku and Linear campaign including incremental reach, audience targeting precision and optimal cross-channel frequency for key segments: New Movers, Renters, and Homeowners. Leveraging VideoAmp’s TV data and industry-leading measurement, the Real Estate Brand gained invaluable insights to craft a strategy that prevents ad fatigue while effectively reaching in-market customers during significant life events.

Findings

Leveraging Roku’s exclusive audience targeting (built off of Roku’s proprietary identity data) and VideoAmp’s TV viewership dataset and measurement, the Brand uncovered the incremental reach Roku drove to TV within their target audiences. In addition, they were able to identify ideal frequency, so the Brand could determine how to manage frequency and budget without sacrificing reach.

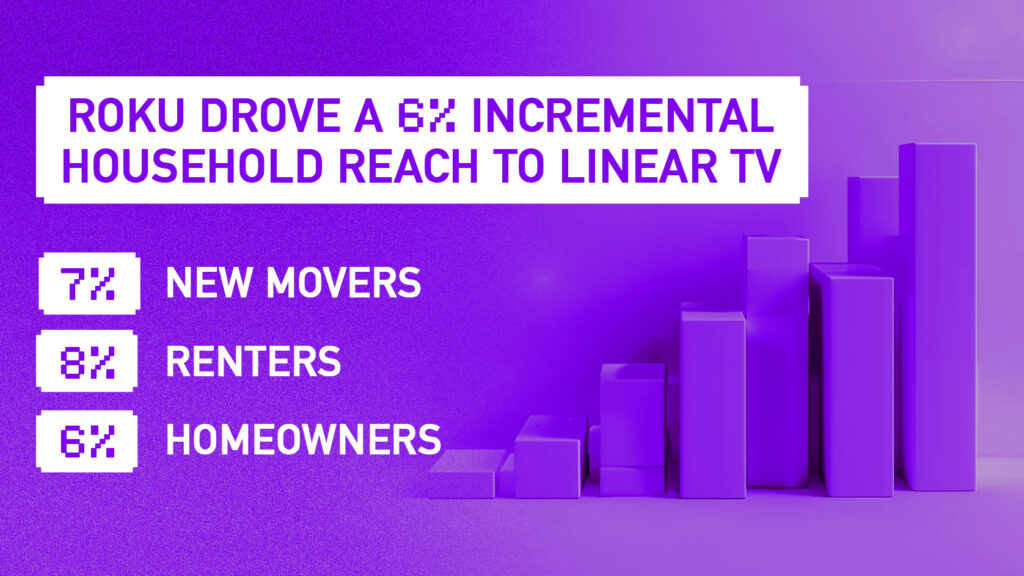

- With only 1.1% of campaign impressions compared to Linear’s 98.9% of impressions, Roku drove an overall 6.1% incremental household reach to linear TV, with higher incremental reach against the target audiences: 7.2% new movers, 8.5% renters, 6.3% homeowners

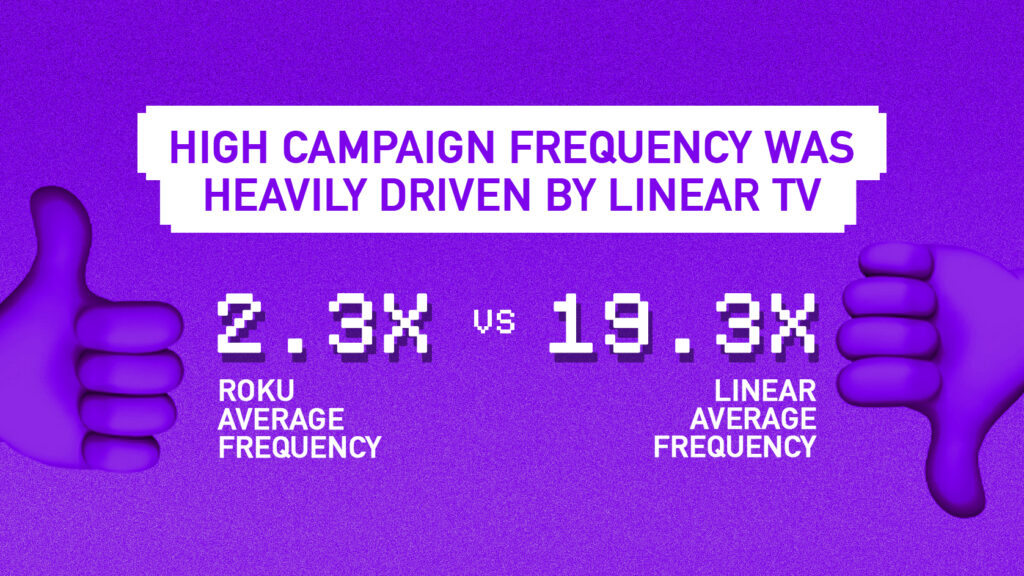

- Cross-channel campaign average frequency was 18.4x, driven heavily by linear TV at 19.3x, compared to only 2.3x on Roku.

- 66% of Linear TV impressions were over-frequency (over 5x/week), which creates an opportunity to shift linear budget to TV streaming platforms, to extend reach of in-market audiences at the optimal frequency.

- Compared to Linear, Roku over-indexed on higher education households and a sweet spot of Adults 25-54, compared to Linear’s primary audience A55-64.

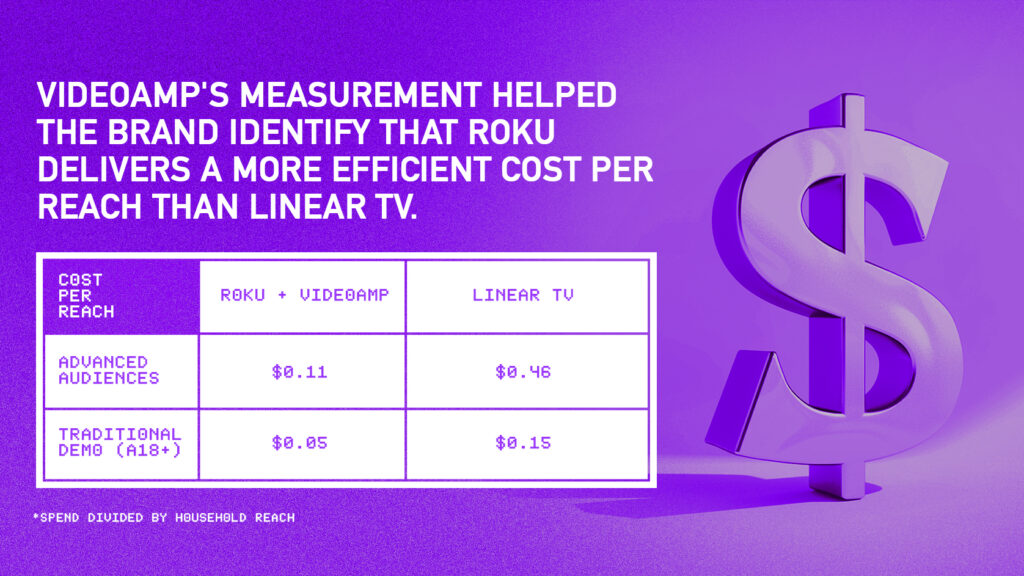

- Roku drove a more efficient cost per reach (Spend divided by Household Reach) to potential customer audiences ($0.11) than linear TV ($0.46) on average across the 3 advanced audiences. Similarly, Roku drove a more efficient cost per reach ($0.05) than linear TV ($0.15) across traditional demos (A18+).

*Please note VideoAmp measurement is only available in the U.S. **Based on hours streamed, December 2022 Hypothesis Group.

**Source: VideoAmp Audience Measurement Reports (5/10/2023 – 6/25/2023) commissioned by Roku for a real estate brand campaign.