Who are the Heavy Streamers?

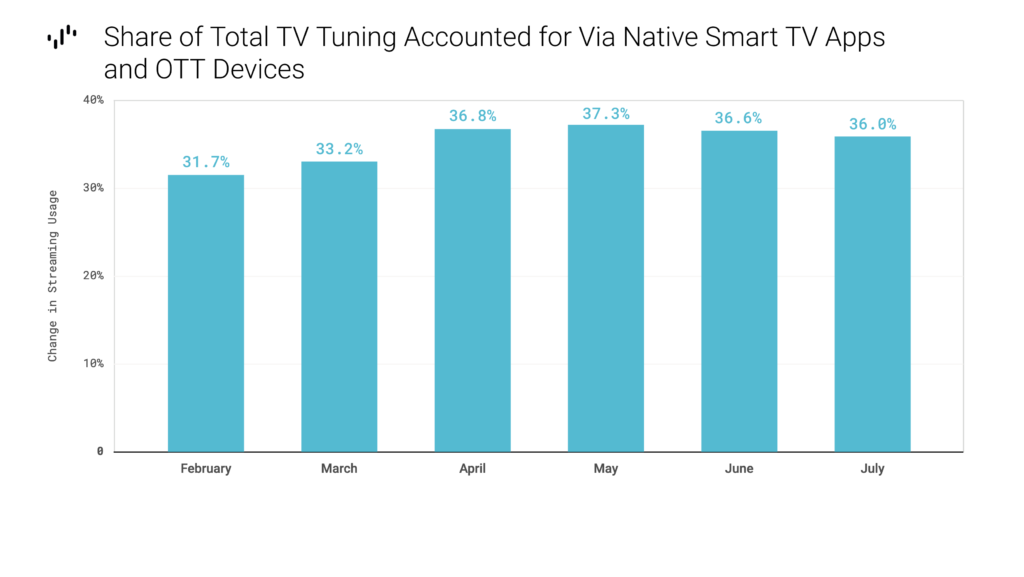

We know that TV is in the middle of a sea change. Smart TVs and OTT devices like Roku, Firestick, and Apple TV are fundamentally changing how we consume video entertainment content, and VideoAmp has seen the pandemic accelerate the migration in share of tuning from linear to streamed content.

As explained in our last blog, Understanding the Unmeasurable, VideoAmp created four audience targets based on time spent with OTT in order to understand the dynamics of streaming: we split all households using streaming into roughly equal-sized cohorts: Heavy-OTT; Medium-OTT; and Light-OTT. We also looked at the remainder of households, which constituted a fourth cohort: Non-OTT. Using the VideoAmp platform, we profiled these four targets demographically. What did we find?

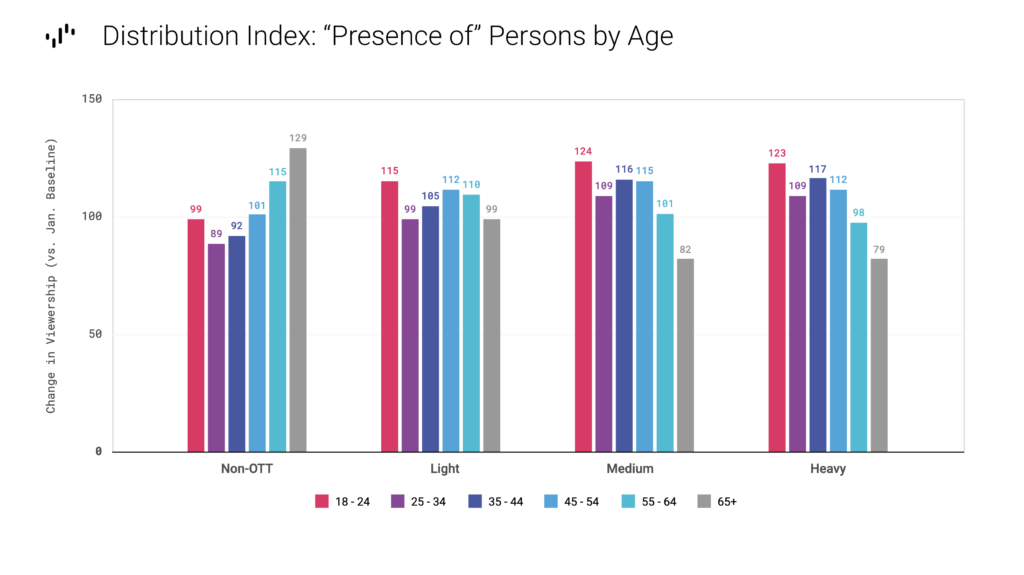

Generally, the older the age cohort, the less likely to stream.

It probably comes as no surprise that from ages 25-34 on, the Non-OTT cohort indexes higher as the age increases (breaking even in the 45-54 age break). Non-streaming households are 29% more likely than average to contain a person 65 or older. Conversely, Medium-OTT and Heavy-OTT households are 24% and 23% more likely, respectively, to be home to an 18-24 year-old.

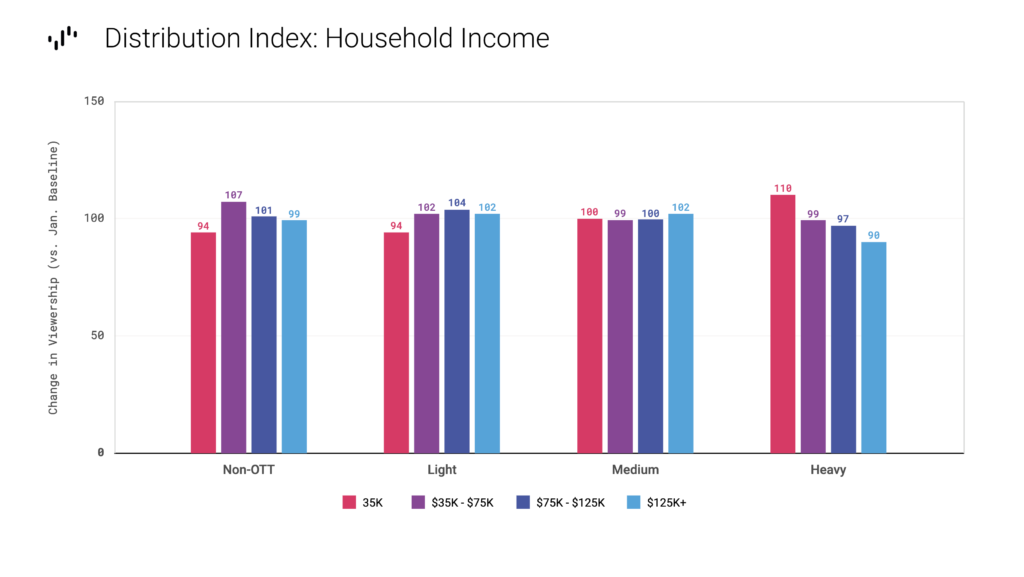

Heavy-OTT HHs exhibit the lowest income skew.

Oftentimes, we assume that the higher income population segments will be the early adopters of technology. When it comes to heavy OTT usage, this appears not to be the case; the Heavy-OTT households exhibit the lowest income skew of the four OTT cohorts examined.

There are two very good reasons for this. First, as we’ve seen, Heavy-OTT households comprise the youngest segment; younger persons are naturally at an earlier point in their careers and earning power. Second, especially as quarantine continues to place a strain on the economy, cord-cutting and cord-shaving have increased as consumers are forced to find ways to save on expenses. Streaming may be a lower-cost alternative to the bundle; indeed this is likely the cohort in which we’d find the majority of cord-cutters and cord-shavers.

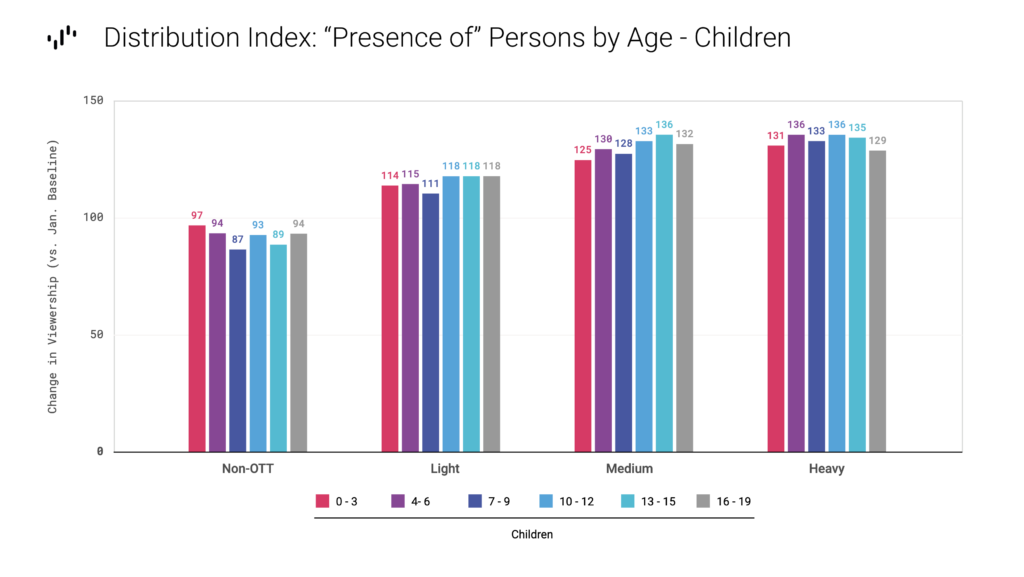

Presence of children in all age brackets increases as streaming increases.

Interestingly, as OTT usage increases, so does the likelihood for presence of children in all age breaks, from the very youngest (birth through 3 years old) to the very oldest (16-18 years old). Heavy-OTT households are between 29% and 36% more likely to have kids in every age break, and Medium-OTT households aren’t far behind. Conversely, Non-OTT households are of below-average likelihood to have kids in every age break.

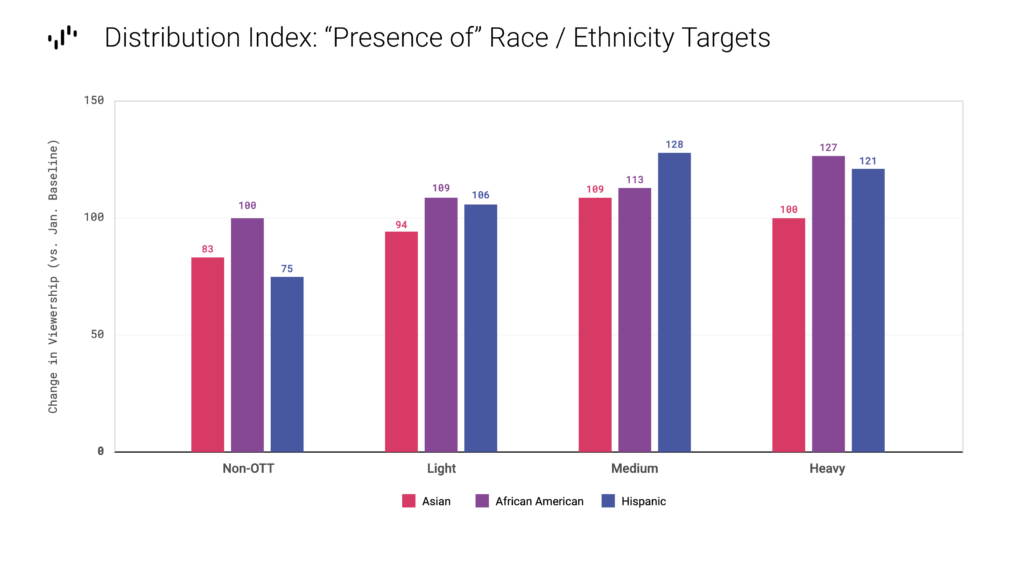

Medium and heavy streaming households over-index for African American and Hispanic persons.

When we cross the OTT segments by race/ethnicity targets, we see that the heavier OTT targets tend to be more diverse. Medium-OTT households over-index by 13% for African American viewers; and by 28% for Hispanic. Heavy-OTT households over-index by 27% for African American viewers, and 21% for Hispanic viewers.

In part, the skew for African American and Hispanic persons may be a function of age; both the African American and the Hispanic US populations skew younger than the general market. According to the US Census Bureau, the median age of the total population as of July 1, 2019 was 38.4; for Hispanics, the median age was 29.8; and for African American, the median age was 34.1.

Asian viewers also see their highest indices against Medium- and Heavy-OTT households, although the variation is not as pronounced. Note that the Asian population are closer in age to the general population, with a median age of 37.2.

So, who are the heavy streamers?

Our heaviest streamers tend to skew young, and are more likely to have children across all ages living in the home. They are a racially and ethnically diverse group, and tend to be less likely to fall in the higher income brackets. Indeed, the Medium-OTT and Light-OTT households are the most likely to be watching a mix of both linear and streaming content, while the Heavy-OTT households are more likely to be cord-cutters and cord-shavers.

As more and more streaming services launch, and as the TV industry diversifies bets across both linear and streaming content, it will be important to keep an eye on how streaming continues to shape the viewing landscape.