The Value of Audience-Based Buying in Today’s Converging World of TV and Digital

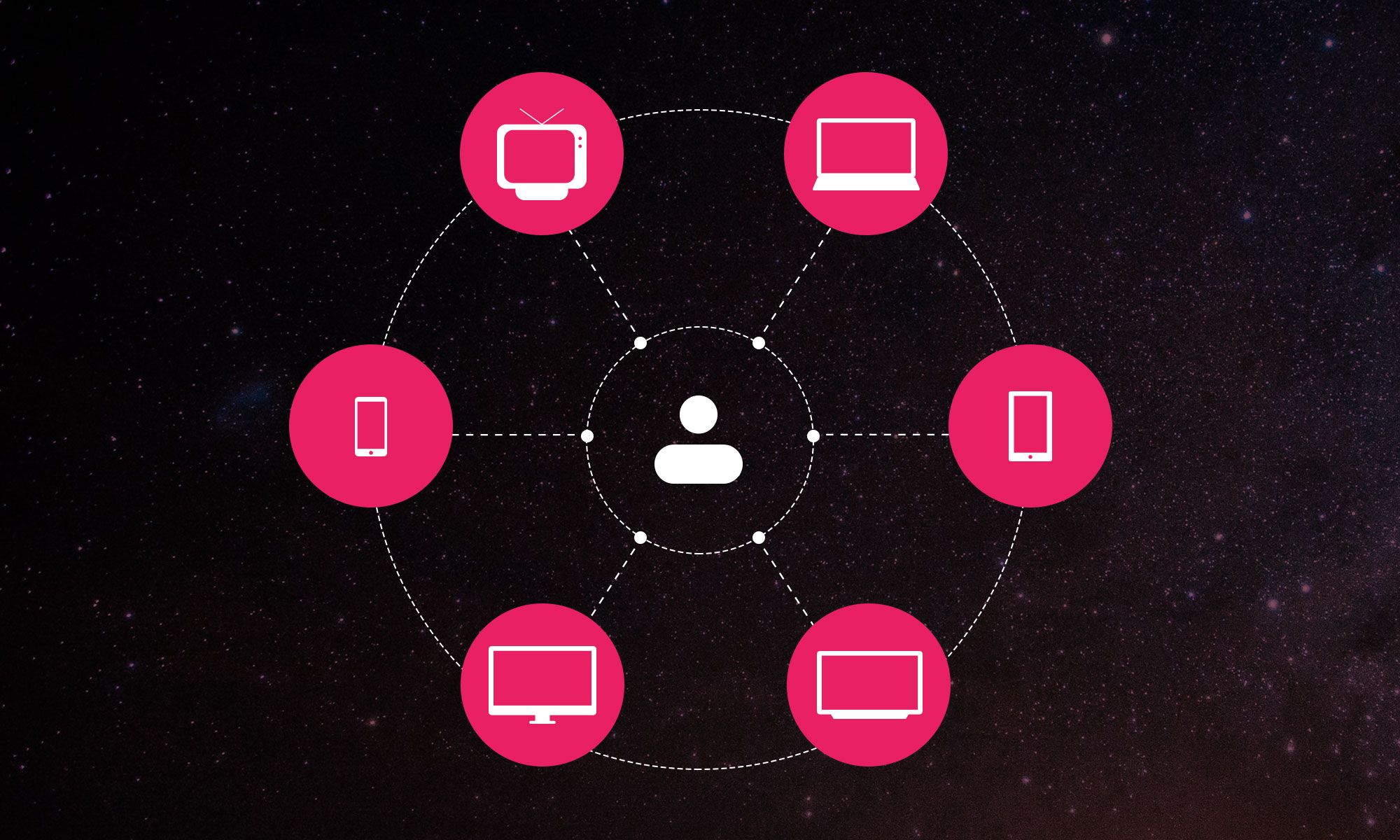

Say what you want about the 50s, but TV advertising was a simple game back then. The war was over, prosperity meant goods were flowing, and advertisers were taking full advantage of an exciting new medium that offered massive reach with great creativity to sell them. The average U.S. family gathered around a single TV set to enjoy a limited range of shows. Cut to today, and we face a fragmented landscape with a multitude of ways for consumers to enjoy content. Increasingly consumers are watching content on different devices and on different platforms (digital video, OTT, cable, etc.) in different rooms. This makes it difficult for advertisers to reach consumers at the right frequency and on the right screens.

Recently, VideoAmp partnered with global market researcher, Ipsos, to better understand the evolution of audience-based buying and how brand marketers, agencies and publishers are tackling the convergence of traditional linear television and digital advertising. Download our survey to learn more.

Making Strides to Consolidate TV and Digital Processes

Our research shows that brands are now recognizing the need for a cohesive, audience-based advertising strategy across TV and digital and are making efforts to streamline how they target audiences. Yet, whilst 71% have a single team in place planning for both TV and digital, 91% still plan each effort separately. It’s critical that brands align their strategies with the agencies they work with around optimizing reach and frequency before they get left behind. Over the next year, combined planning and measurement solutions are expected to grow by around 11% as more brands begin to take a holistic, audience-based buying approach in efforts to maximize their investments.

The good news is that a majority of agencies have started to embrace an audience-based buying approach in their advertising. Many are considering cross-screen platforms like VideoAmp to help them plan, measure and execute more efficiently. Over a third already use a single software solution for cross-screen planning and measurement, and this trend will continue over the next year or so.

One of the major challenges that agencies face is “identifying and engaging audiences more quickly, efficiently and accurately”, and this is one of the big reasons why we’re seeing greater investment into advanced measurement software tools. By taking a holistic approach, agencies can help their brand customers look at linear and digital investments and results in tandem to know where to target, then execute a dynamic, informed campaign.

To hear tips from a leading agency on how it has optimized its media investments across TV and digital with VideoAmp’s cross-screen platform, register for our on-demand webinar.

Publishers (known as sellers in our survey) have also been impacted by today’s convergence of TV and digital. More than half of the sellers interviewed admitted that their customers were demanding audience-based buying of their TV inventory, yet the vast majority didn’t make audience data readily available. Sellers also are continuing to use their TV and digital data separately (TV data for internal purposes and digital for informed programming decisions). It’s now more important than ever that sellers provide their customers what they want; both buyers and consumers.

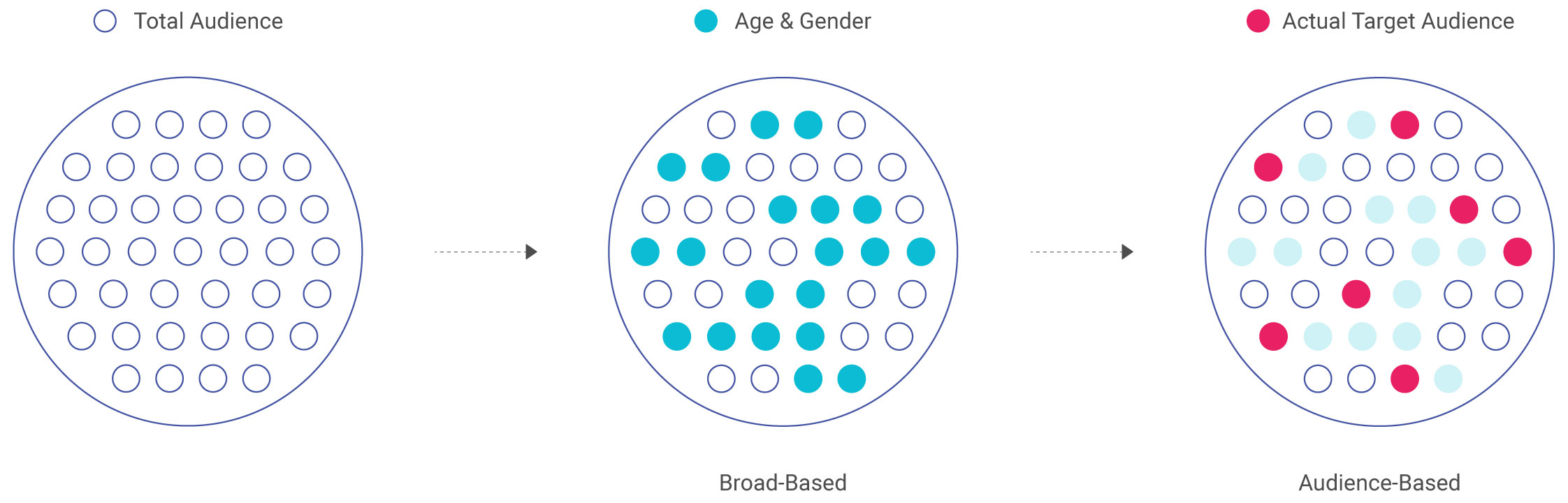

Evolving Away from Broad-Based Tactics to Smarter, Audience-Based Decisions

When asked “How important is improving your ability to effectively plan and measure your investments across TV and digital?”, our survey showed 76% of agencies and 57% of brands feel it is critical to improve their ability to plan and measure across TV and digital. Agencies feel it is particularly crucial to their competitive advantage due to most brands relying on agencies to plan and measure cross-screen effectiveness for them.

But operational challenges continue to prevent brands and agencies from evolving as quickly as they should. Although approximately 65% to 75% of media buyers want to make smarter, audience-based buying decisions for both digital and linear, only 47% execute their campaigns with 1st-party data, and 41% execute with 3rd-party data.

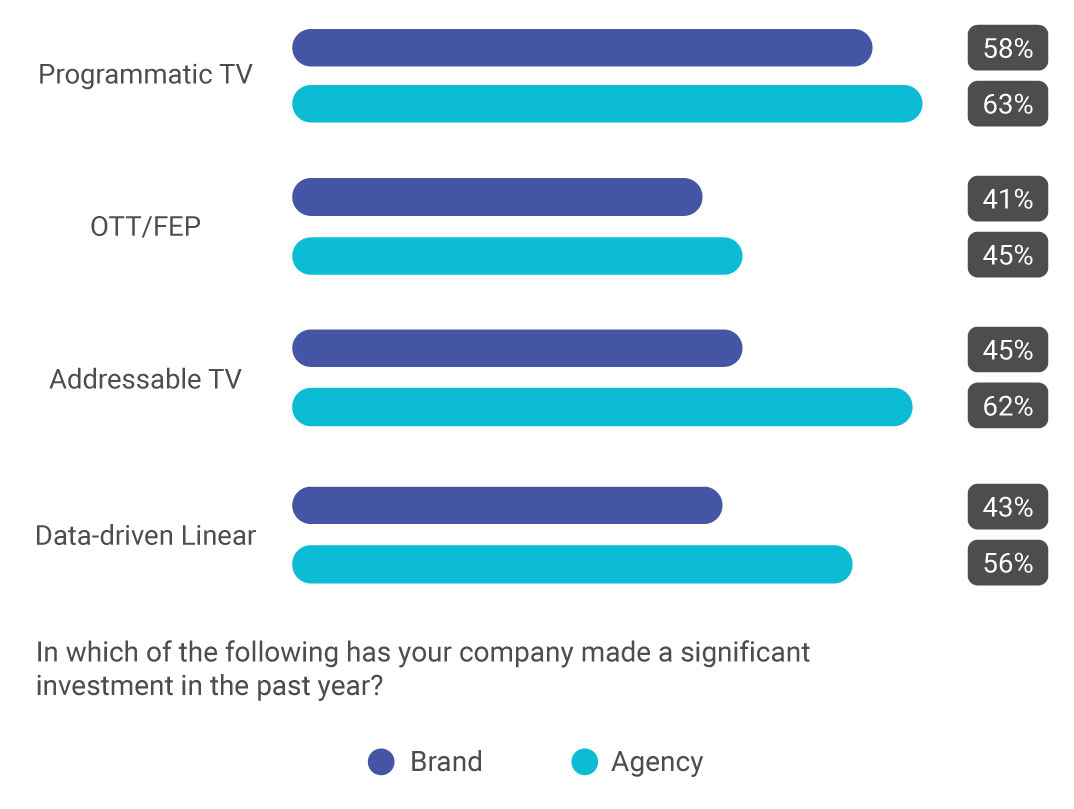

After breaking down what kind of TV investments are currently being made, we found 100% of agencies have already invested in one or more of the following:

- Programmatic TV (63%)

- Addressable TV (62%)

- Data-driven linear (56%)

- OTT/FEP (45%)

Brands, on the other hand, typically use part of their TV budget or a separate budget category to make these investments.

Sellers are Tasked with Providing More Advanced Audience-Based Data

Media sellers are currently facing a variety of challenges to cater to their customers’ needs. Right now, most sellers plan, execute, measure and sell each channel separately and independently; when it comes to programming, more than a third plan and measure inventory holistically while programming and selling separately. It’s certainly something that is playing on sellers’ minds as they are nearly unanimous in their desire to improve the granularity, timeliness and/or responsiveness of data measurement, processing and activation in order to allow for real-time actionable insights.

Overall, sellers want to package up inventory across linear and digital and are interested in creating a neutral marketplace with advanced audience data.

Succeeding in a Converged World of TV and Digital

To help navigate the fragmented media landscape and reach more of their desired target audience, brands, agencies and sellers must harness the power of audience-based data over traditional broad-based age and gender methodologies. Download our ebook to learn more about the benefits of implementing an audience-based buying approach.