For Brains, It’s Largely a Seller’s Market

As a CTO of a rapidly growing tech startup, I have noticed that it is a battle to get top technical / engineering talent, and at VideoAmp, we settle for nothing less. I reached out to my network and beyond to get some input from other CTOs on their biggest pain points.

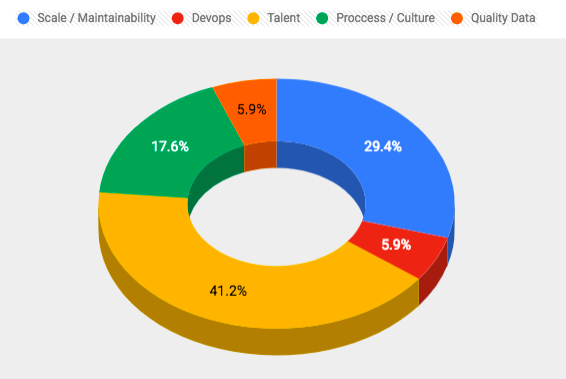

With these research results in hand, I identified the top five pain points or today’s startup CTOs.

Method

I asked about 2 dozen CTOs and technology leaders a simple question:“What is your biggest pain point right now, and what’s the size of your org?” I decided to talk about the responses with respect to org size, and relate that to what we’re seeing at VideoAmp right now.

The data gathering method was based off of a Google Form consisting of a free-form text area, and a drop down of various company sizes. The responses were 85% from LA-based CTOs, and the remaining from Austin, TX. In order to summarize the data, the responses are bucketed into 5 categories.

Top 5 Pain Points of CTOs

Let’s dive into these responses from least to most “painful,” and talk about how they skewed in terms of company size.

5. DevOps

This response skewed towards companies of 100+. It’s reasonable to suggest that this could also roll up under process. However, the particular pain point here is that it can be tough to teach an old dog new tricks.

For Amit Nayar, who was recently brought on as a force-multiplier for the engineering team at FloQast, hiring, recruiting, and internal team operations were among his first concerns, but the topmost was devops. “The team is great at developing software, however getting it deployed consistently and quickly was one of the initial challenges I saw when coming aboard.”

For Amit, fostering a culture of devops excellence and continuous delivery are the most impactful part of his charter at this burgeoning post-series-B startup.

4. Quality Data

This one resonates with VideoAmp as well, as we’re now just as much a data company as we are a software company. The responses tended towards companies with <50 engineers. Not only does society accumulate an ever-increasing amount of data per year (the new Moore’s Law), but that data comes in so many formats and flavors, and often arrives in poor quality, “garbage-in” formats.

By 2020, humanity’s accumulated data is estimated to be at 44 Trillion Gigabytes. With so much data, how do you structure and make sense of it all? This is the focus of many companies, old and new. As Rich Robison, CTO at myHouseby told me:

“As we transform an entire market, one of our biggest challenges is getting the right data to do so. The house construction industry still tracks much of their work with spreadsheets, fragmented and decentralized even within a single company. There’s no uniform data solution accepted by a majority of builders, so we have to be innovative in how we gather and process data from them in order to give the superior experience consumers demand. We must first adapt to the current data practices in the industry, but as we support enough builders we can help transform it and drive data efficiencies. “

3. Process / Culture

This response was popular in companies in the 11–50 person range, and is expected as companies of this size are in emergent states, and typically growing rapidly.

The responses included: lack of process consistency, nebulous definitions of success, lack of KPIs, and treating engineering talent like “brains” and not “bodies” when it comes to incentives and benefits.

Suffice it to say, this has been one of our continuing challenges as VideoAmp has scaled from 6 to 12 to 20, 40, and 55+ engineers.

2. Scale / Maintainability

This is a broad bucket, and therefore results were varied across all company sizes. The answers skewed more towards scale of development processes for smaller companies, and more towards scale and maintainability of actual services in larger companies, along with the need to break- up monolithic services into microservices.

There’s nothing really surprising about this spread, as smaller companies are typically going through growing pains. Meanwhile, large companies by definition are going to typically have more customers to serve, more scale requirements of systems, and the most accumulation of technical debt such as monoliths.

1. The Most Painful: Elite Technical Talent Acquisition

This was the predominant response across all companies I surveyed regardless of scale, and validates our challenge here at VideoAmp. Today’s market is the most competitive for elite engineering talent I’ve ever seen from the hiring side of the table.

It’s not surprising when you consider unemployment is at an all-time low. This is especially the case coming out of the April / May timeframe which is the peak of hiring season. This is when new grads come out of university, the shining stars with experience and desire to grow get promoted to lead and/or manage them, and folks generally move about the country more often (before the holidays and wintery weather).

This observation is more than anecdotal. In a past role, I operated the ecommerce portions of a high scale career site for about three years, and gathered this data directly.

Another indicator that this is a tough market is that the most gifted among elite engineers are abandoning signed offers. I have seen this once or twice over a decade where someone signs an offer, and then before their start date vacations in Costa Rica, meets someone, gets married and decides to stay there. It’s a great story, and yet another reminder on the path to successful technical staffing that “life happens.”