The Over-Under: Live Sports Return

If we had a dollar for every time this year has left advertisers thinking, “what could possibly happen next?” we’d never have to work a day again in our lives. Back in March, when live sports got the axe, many brands and agencies were left trying to piece together flexible media plans and find their audiences outside of their traditional viewing behaviors. VideoAmp put together a series of insights tracking these changes, including Shift Happens and For the Love of the Game, specifically for the sports viewer, to help our partners understand where audiences had gone if indeed they were tuning in to linear at all. The proverbial light at the end of that tunnel? Sports, one day, would return, and so too would their audiences (and advertising revenue).

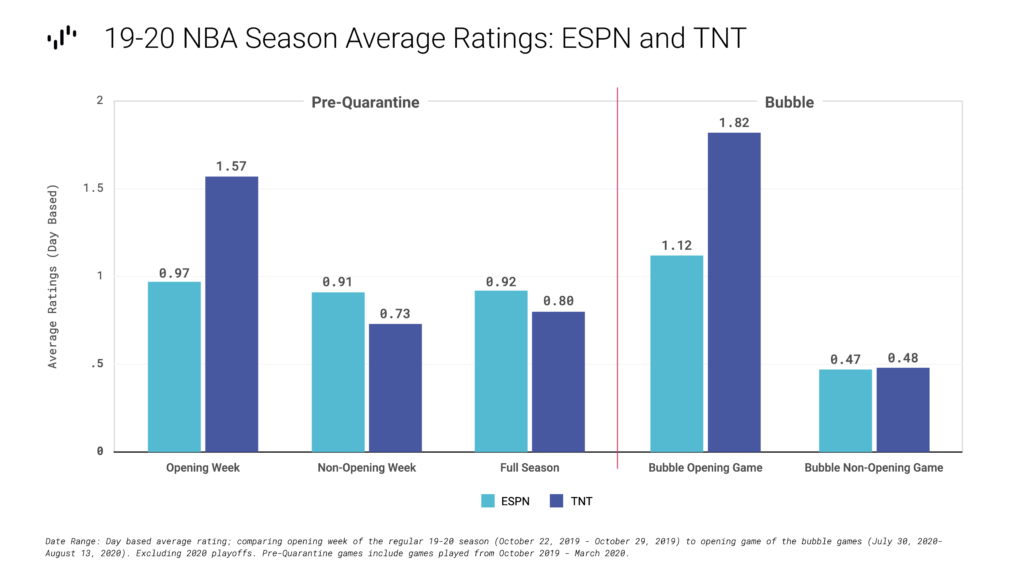

Given the industry speculation of these “sports starved” audiences anxiously awaiting their long-delayed live games, the question we sought out to answer was simple: with the return of live sports, would viewership ratings skyrocket? We’re living in a world of unknowns with variables the industry has never seen; at VideoAmp, we’re committed to developing analysis based on the information available, and creating comparisons that make sense. While we can’t compare this global pandemic to anything else, we can draw hypotheses and conclusions based on advanced data and analytics. For this analysis, we looked further at the NBA and compared viewership data from pre-quarantine games (October 2019 to March 2020) to what we’ve dubbed the NBA’s Bubble games, measured beginning July 30, 2020 to August 13, 2020, excluding playoffs, across ESPN and TNT networks.

The predicted comeback was more of an airball as our data uncovered underwhelming results with significantly lower viewership levels than the pre-quarantine regular NBA season. Perhaps a better comparison is to look at opening week games, when viewership tends to be much higher, versus non-opening week games, when many “light” sports fans have tuned out. In looking at this time frame, during pre-quarantine games on ESPN and TNT, viewership decreased 6% and 53%, respectively.

Flash forward to the Bubble games on the same networks, looking at the same comparison (opening week vs. non-opening week), viewership dipped 57% and 74%, respectively. For a more controlled analysis, we examined ESPN and TNT’s “owned nights”, Wednesday and Tuesday, respectively, and also found a significant dip in viewership versus the regular season.

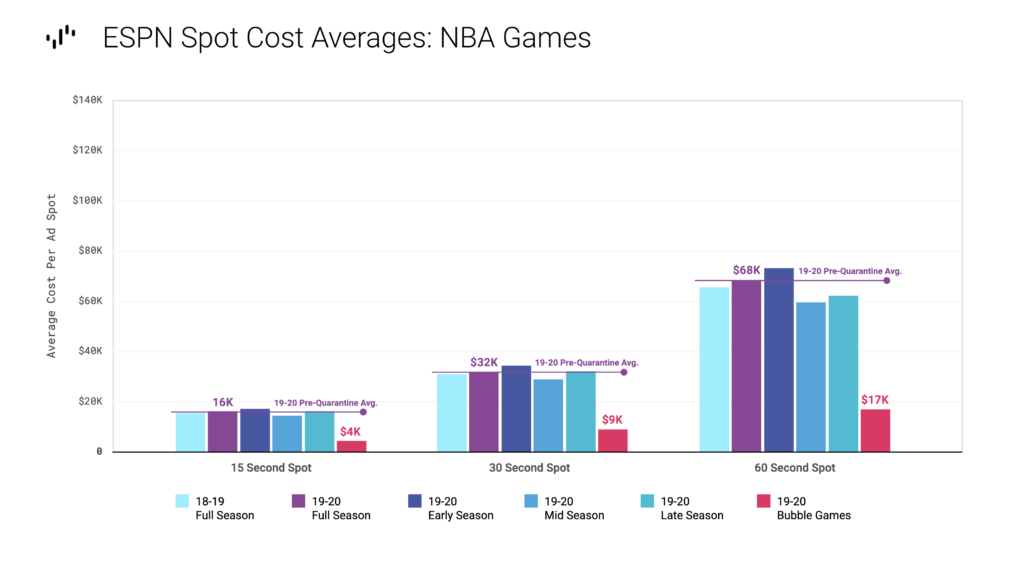

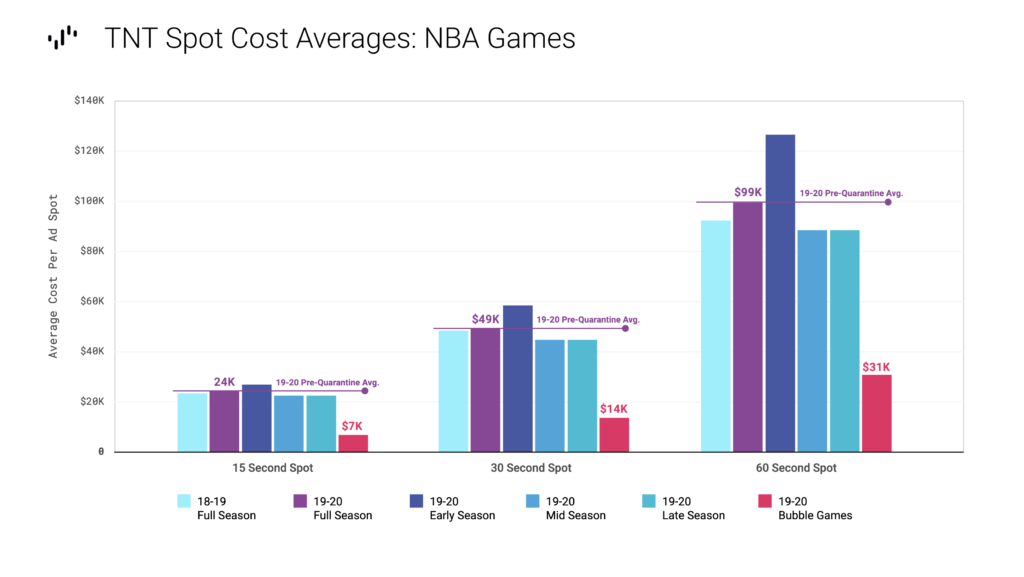

Whether the lack of engagement is tied to social issues off the court, an absence of what feels like real “competition”, an increase in cord-cutters, or simply that viewers have found other ways to fill their time while under stay at home orders, measurement based only on gross viewership doesn’t do much to help advertisers who are grappling to figure out where to go from here. In fact, many advertisers geared up for higher ad spot costs as the demand for live sports was expected to surge during the comeback. Coincidentally, and in true 2020 fashion, that doesn’t seem to be the case, either. The average cost for a 15, 30 and 60 second ad spot across ESPN and TNT was significantly lower during the Bubble games, as compared to the pre-quarantine average.

While it is true that we’re seeing a supply and demand correlation between ad spot pricing and viewership, it has certainly taken an unexpected shift. Easy access to captivated audiences during live sporting events no longer exists. The audience is out there, but they’re making advertisers work harder than ever to not only find them, but also align ad spots at the right costs to get the right reach.

Now more than ever, advertisers must shift their focus from measuring the number of eyeballs that tuned in to targeting Advanced Audiences that go beyond age and gender in order to plan, buy and measure across platforms. Flexibility is the new F word, and if the past 9 months has been any indication of what’s to come, this year still has a few rebounds- or crossovers- up its sleeve.